We are so used to instant cash withdrawals and digital transactions now that we cannot imagine how transactions happened before the evolution of modern technologies in the banking sector. When it comes to owning a bank account, a bank offers the bank passbook, chequebook, ATM card/debit card/credit card along with the PIN to the customer when opening the bank account.

Concerning the State Bank of India, it is provided with a green PIN facility for the customers. This means the customer can generate the ATM PIN from the comfort of home through SMS. You do not have to visit the bank to get the PIN. This was introduced to save paper wastage. Now, let us see how for generating SBI ATM PIN through SMS.

How for generating SBI ATM PIN through SMS?

Here is a brief about how you can set SBI ATM PIN through SMS. As we already mentioned, the green PIN is used to set a permanent SBI ATM PIN. You will need the registered mobile number for generating SBI ATM PIN through SMS.

Green PIN is not the ATM PIN that you can use to make your ATM transactions. Green PIN is just the temporary PIN that you can use for generating the actual ATM PIN. Once you receive the green PIN in your registered mobile number, you should visit the nearby SBI ATM for generating the ATM PIN.

Therefore, for generating SBI ATM PIN through SMS, you will require the registered mobile number with the bank. Without the registered mobile number, you cannot generate SBI ATM PIN.

There are also a few more ways for generating the green PIN. But, before going to that, let us see how for generating SBI ATM PIN through SMS. Follow the instructions below.

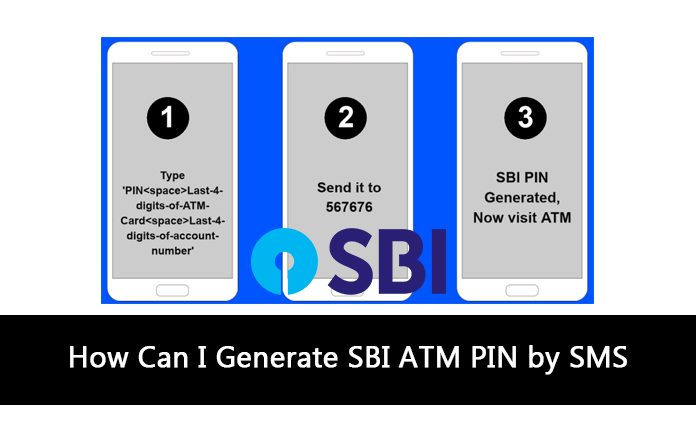

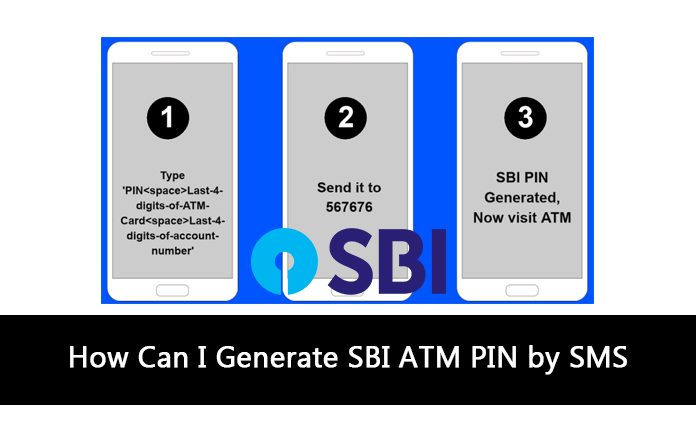

- Step 1 – From your registered mobile number, you need to send an SMS to the State Bank of India. Make sure you have an active SIM plan to send an SMS.

- Step 2 – Follow the below format to send the SMS.

SMS PIN IJKL MNBH (Note: IJKL denotes the last four digits of your SBI ATM card, while MNBH denotes the last four digits of your SBI bank account number)

Send the SMS to 567676.

- Step 3 – After sending the SMS in the above format, the bank will send you an OTP to the registered mobile number.

- Step 4 – After getting the OTP, go to the nearby SBI ATM in the next 48 hours and generate the ATM PIN using the OTP you had received.

Below are the steps for generating SBI ATM PIN at SBI ATM.

- STEP 1 – First, you should go to the nearby SBI ATM for the procedure. Insert or swipe your SBI ATM card into the ATM.

- STEP 2 – Many options will appear on the screen. Select the PIN generation option.

- STEP 3 – Now, the screen will ask you to enter your 11 digit SBI bank account number. Enter the account number correctly and press confirm. You can find the account number in the past book.

- STEP 4 – Now, the screen will ask you to enter your 10 digits mobile number that you have registered with the bank. Type the exact mobile number and press confirm button.

- STEP 5 – Now, the screen will show the thank you message for engaging in SBI’s green PIN initiative. Press confirm button to proceed with the next step.

- STEP 6 – Now, the screen will show that your PIN generation transaction is successful. It will also say that you will receive your PIN shortly through your registered mobile number.

In your registered mobile number, you will receive the green PIN or temporary PIN. You should use this temporary PIN to set the permanent PIN.

- STEP 7 – Now, after finishing the procedure insert your ATM card again into the machine and finish the last step of ATM PIN generation.

- STEP 8 – Once the card is inserted, select the banking option and press the PIN Change option. Now, you will be asked to enter the temporary PIN, which you had received on your registered phone number. Now, you can set the permanent SBI ATM PIN.

You’re all done! Make sure you set the PIN that you can remember. Use this PIN in the future to make all your ATM transactions.

There are a few other methods as well for generating SBI ATM PIN.

Generate SBI ATM PIN through customer care

You can call the customer care number of the State Bank of India for generating SBI ATM PIN.

To do this, follow the below process:

- STEP 1 – From your registered mobile number, call SBI’s toll-free customer care number 1800 11 22 11/ 1800 425 3800 or 080-26599990.

- STEP 2 – Follow the instructions given in the call and select the ATM and Prepaid Card Services option.

- STEP 3 – Enter 1 for generating your ATM PIN.

- STEP 4 – In the call, you will be asked to enter the ATM card number. Enter the number correctly and confirm it.

- STEP 5 – Next, you will be asked to enter the account number. Enter the account, number correctly and confirm it.

- STEP 6 – After completing all the steps as per the instructions in the call, you will get the OTP on your registered mobile number. This OTP will be valid for 48 hours. With this OTP, you can go to the nearest ATM for generating your permanent ATM PIN.

Generate SBI ATM PIN through internet banking

For generating SBI ATM PIN via internet banking, you should have a device will a proper internet connection. You can use either laptop or PC or smartphone to do it. A tablet will also do just fine.

- STEP 1 – Go to the SBI internet banking website https://retail.onlinesbi.com/retail/login.htm.

- STEP 2 – Login to your internet banking account using your username and password. After logging in, a new page will appear. From the available menu, select the ATM PIN generation option.

- STEP 3 – Follow the appropriate steps as per the instructions for generating your ATM PIN.

All the above three methods for generating ATM PIN are quite simple. Follow any of the above methods according to your preference for generating SBI ATM PIN. While entering an account number or mobile number in respective fields, make sure you enter them correctly without any mistakes. For any queries or help, you can always contact SBI’s customer support number. We tried to cover all the possible ways for generating SBI ATM PIN. We hope the article was helpful to you!

Contents In This Article