When you open a bank account, there are two chances. You might end up using the account forever, or you might end up closing it. Either way is fine and completely within your rights. When it comes to RBL bank, if you are wishing to close the bank account online, the process isn’t as complicated as you think it is.

With more and more prevalence of digital banking in India, it isn’t surprising that people now prefer using online means to close their bank accounts instead of opting for an in-person visit to the bank account.

If you are looking into ways to close your RBL bank account online, here’s how you can do it.

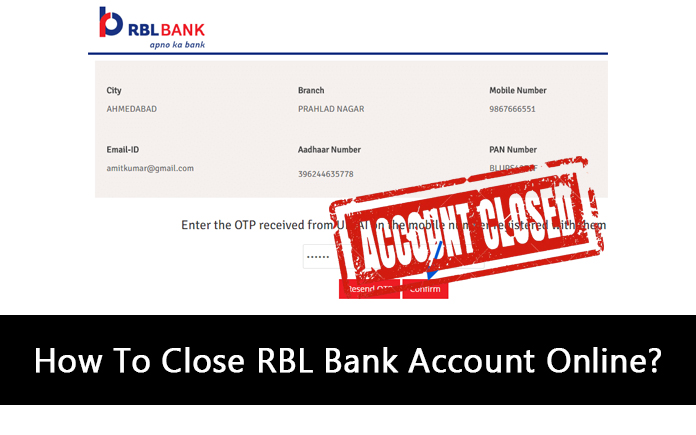

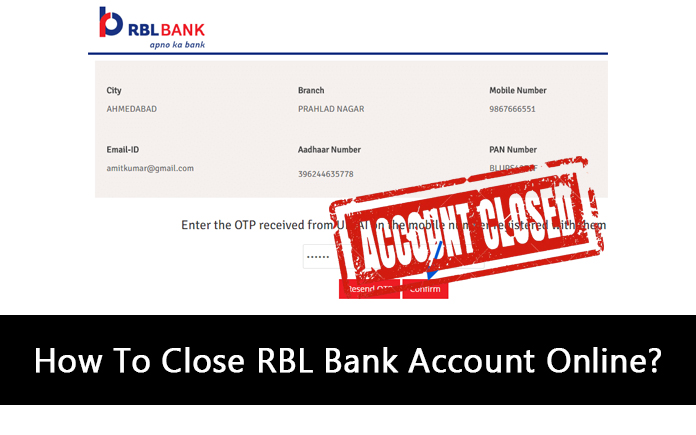

How To Close RBL Bank Account?

The steps to closing the RBL bank account are not as complicated as you think. Ideally, it is a simple five-step process, one that shouldn’t take you a lot of time. However, keep in mind that you need to submit all the associated details when it comes to closing the RBL bank account.

Here’s what you need to do:

- The first thing you need to do is get your hands on the RBL account closure forms. You can either download it online or you can visit your nearby branch to sort out the same.

- Once you have the closure form with you, fill in all the details and the fields in the form. Make sure you sign in the designated areas on the area. If it is a joint account, all the account holders need to sign on the form. This is the form that you will submit to the manager in charge of your home branch.

- With the closure form, you also need to submit photocopies of your KYC details. This includes your Aadhar card, photograph, etc. You need to submit an address proof too. Make sure that these documents are self-attested before you submit them.

- While closing the RBL bank account, you need to surrender the debit card, passbook, remaining cheques with the application form. This is for safety measures.

- If you have any remnant balance in your bank account, you need to withdraw or transfer the existing funds before the account is closed.

For a successful closure of the RBL bank account, these are some of the standard steps that you need to follow.

Accessory Information Regarding the RBL Bank Account Closure

Besides the above-mentioned steps, there are a few accessory pointers that you need to keep a check-in on before you can close the RBL bank account.

Following are the pointers you need to be mindful of:

- You can only close the RBL bank account after visiting the home branch where you opened the account.

- You should only consider closing the account if you don’t plan to reopen it in the future.

- Make sure you download or save the complete bank statement before closing the bank account. Keep this for future references.

- If there are automated payments associated with this account, you need to terminate or cancel them immediately.

- If your bank account has levied charges or it is in a negative balance, you need to clear out all those dues with immediate effect.

These are some of the crucial pointers worth considering. Make sure that you keep a check on all these factors before you go through with the account closure procedure.

How to Close a Current Account at RBL Bank?

Since current accounts have more benefits than a savings account, their closure procedure is quite different too. For closing the current account, you need to submit an application to the bank’s branch manager citing all the reasons why you want to close the account.

You can write an application as mentioned:

To,

The Bank Manager,

RBL Bank,

Bhopal (M.P)

Subject: Close saving bank account with RBL

This letter is a request to close my RBL bank account 12345667. I haven’t used this account in a long time. Now I’ve chosen not to keep this account. I’m returning my debit/credit card, passbook, and chequebook to the bank branch attached with the account closure form. I request you to repay my existing balance via demand draft or transfer it to my new account.

It would be great if you do it as soon as possible.

Thanking You

Yours Faithfully,

(Name and Signature with Date)

Account No.- xxx-xxx-xxx-xxx

With the application addressed to the branch manager, you also need to submit the KYC documents and the other required documentation to speed track the process. Make sure you have sorted through all the processes before you get to closing the bank account.

You might need to discuss the reasoning behind closing the account in depth with the branch manager before they go ahead and close the account for good.

Why should you Close the RBL Bank account?

There is no standard reasoning for it. Ideally, we’d recommend that you close the bank account if you aren’t able to maintain the account or don’t have any need for it. Also, RBL bank has very limited branches across India, so if you are moving to a state or city where the bank isn’t easily accessible, that is another reason why you might consider changing it.

Some individuals also consider closing the RBL bank account because they want to switch to a more diverse and versatile bank. It could be a nationalized bank or it could be a private bank as well. What we are trying to say is that the reason behind closing the RBL bank account is subjective. It depends on the customer’s reasons only.

However, if you are closing the RBL bank account, ensure that you follow all the steps that we have sorted out here. The process isn’t as complicated as you think it is. So, if you are confused and don’t have much idea about the same, we’d recommend that you follow through with the pointers we have shared in the article. Also, keep in mind that you can download the closure application online but you need to visit the bank to close the account.

Contents In This Article