Having multiple bank accounts has become common nowadays. Though people have their reasons to possess more than one bank account, it is practically difficult and quite confusing to maintain numerous bank accounts. Maintaining a minimum balance in all the bank accounts is also tiresome. If you are an account holder of Union Bank Of India and wish to close the account, we are here to help you!

This article will guide you with a step-by-step process to close the Union Bank Of India Bank Account. But, can you close the Union Bank Of India Bank Account Online? Find out from below.

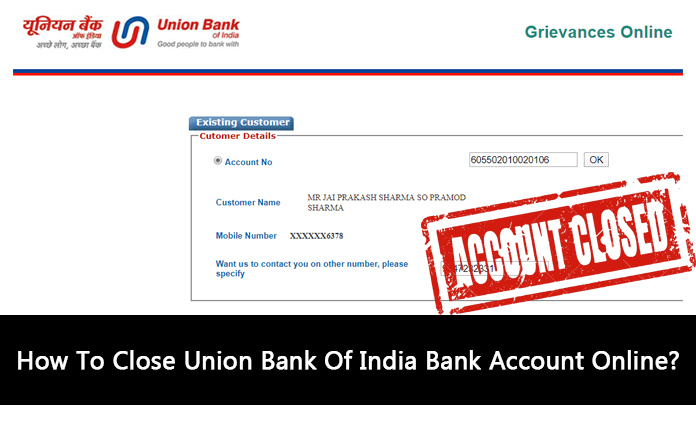

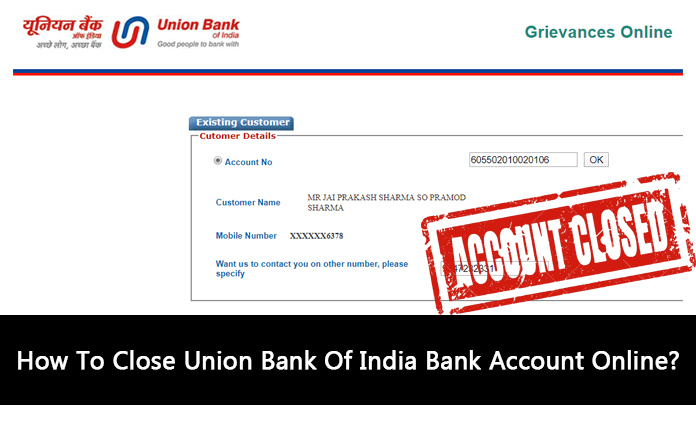

If you hadn’t already known, Union Bank Of India does not allow its customers to close their Bank account online. You can proceed with the important steps to close the Union Bank Of India Bank account online. But, you cannot just do the full process online. You have to manually visit the bank. Below is the step-by-step guide to close your Union Bank Of India Bank account online.

A step-by-step guide to close Union Bank Of India Bank account online

Not satisfied with the services offered by Union Bank Of India? Do you wish to change to a different bank and close your current Union Bank Of India bank account? Then, follow the below steps.

- STEP 1: You will need the account closure form to close your Union Bank Of India bank account. The account closure form can either be downloaded from the bank’s official website https://www.unionbankofindia.co.in/english/home.aspx or manually fetched from the nearest branch of Union Bank Of India.

- STEP 2: Now, fill in the details asked in the form. Ensure you fill in the right details without any errors, as only then your account closure form will be accepted. Errors can result in a delay in account closure.

- STEP 3: You will be asked to fill in your name, address, bank account number, date of birth, phone number, your choice to receive the pending bank balance amount through cash/cheque/fund transfer to some other bank account.

- STEP 4: After filling in the necessary details, the account holder should sign in the form.

- STEP 5: Now, it’s time to submit the filled account closure form at the bank.

- STEP 6: Along with the form, you also have to submit your KYC documents. These are your identity proof and address proof documents.

Apart from these, you also have to submit your bank ATM / Debit card, chequebook / pending cheque leaves. Also, ensure your account balance is zero before closing the account. If you have a pending account balance, the bank will hand over that amount to you.

You do not have to worry about that. The amount will be given to you either in the form of cash/cheque. The bank can also carry out fund transfers to some other bank account if you request to do so.

All done! Now that you have submitted the account closure form and done your part, wait for the bank to respond to your account closure request. Remember, the bank may respond soon in a day or two if you are lucky or may even take weeks. It depends on several factors like circumstance, the accuracy of info and other things. If all goes well, you can close your bank account in 2 or 3 days. If it takes long, wait with patience to get your job done.

There is no online option to close your Union Bank Of India bank account. Follow the above-listed steps to close the account. It is a pretty simple process, and we’re sure you won’t face any hurdles while doing it. If you have any queries or need clarifications, you can always call the customer care number or helpline number of Union Bank Of India for help.

Common reasons why people close the bank account

There are various reasons for account holders wishing to close their bank account. We have listed some of the common reasons.

- The account holder cannot find the nearest branch of the bank from their home. They might have moved to a new city or state. Though online transactions and internet banking are available, sometimes you have to manually visit the bank branch to get some things done. If the bank branch is far from your home or workplace, it is quite difficult for the customers to get their banking works done.

- Another common reason for closing a bank account is having many numbers of bank accounts. A person may possess multiple bank accounts. Maintaining many bank accounts might get difficult at times. So, the customer would have opted for closing one of the bank accounts.

- The next reason is if the minimum bank balance is high. Like you know, some private banks expect their customers to maintain a minimum bank balance. If this amount is high, many customers may find it difficult to maintain, so naturally, they’d opt for closing the account and opening a different bank account with a low or nil minimum bank balance.

- If the online services and app of the bank are not user friendly, then customers may think of shifting to some other user-friendly bank. The apps and online services of some bank accounts are quite complicated and users may find it difficult to access.

- If the bank charges a high fee for financial transactions, that is considered a drawback. Numerous banks offer little to no fee for financial transactions. So, the customers may get attracted to those banks and close the account in the bank that charges a high fee.

- Another reason for closing the bank account is the low-interest rate. If the interest rate offered by the bank is less and not satisfactory, the customer may shift to a bank that offers higher interest.

Now that you know how to close your Union Bank Of India bank account online, share the article with your friends and family and pass the information on!