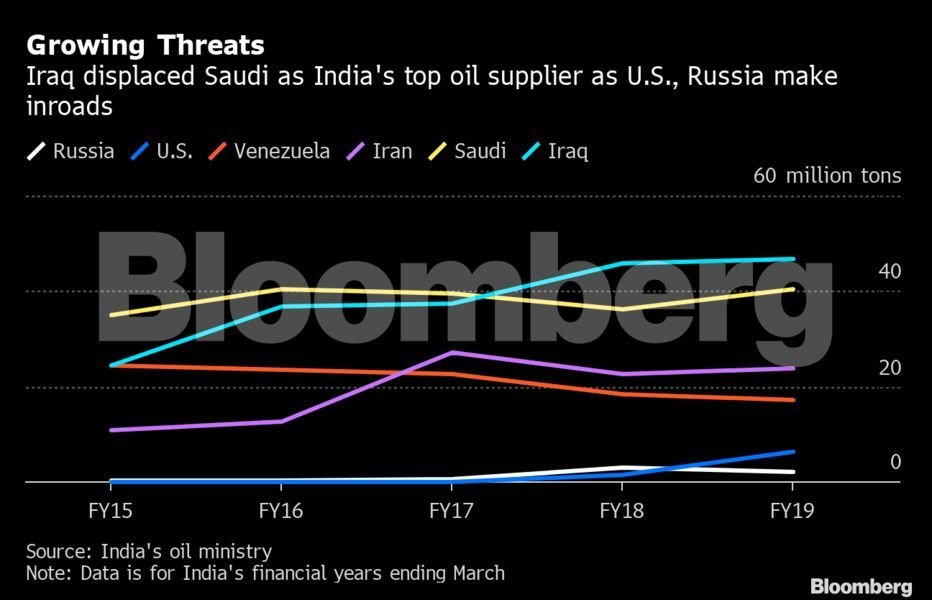

Saudi Aramco’s proposed purchase of part of Reliance Industries Ltd will allow it to secure back its hold on the fastest-growing oil market in the world where suppliers including Russia and US are making inroads.

Aramco is planning to buy 20% of the oil-to-chemicals business of Reliance which includes the world’s biggest refining complex at Jamnagar on the western coast of India. They come with an assurance to buy half a million barrels a day of the kingdom’s crude for a long period of time. That’s around 25 million tonnes a year and will allow Saudi Arabia to easily reclaim the top supplier spot from Iraq.

Asia has always bought the bulk of its oil from the Middle East. However, things seem to change as the US ramps up shale exports, Russia looks for new customers and Saudi Arabia leads OPEC efforts to curb production to prop up prices. American sanctions on Venezuela and Iran are also taking barrels off the market and providing an opening for new suppliers.

Sushant Gupta, director of refining and chemicals for the Asia Pacific at energy consultancy Wood Mackenzie Ltd. in Singapore said:

“The deal definitely gives Aramco access in a market where they are facing competition from other producers.” He also added, “Incremental demand in Asia is being met more by other suppliers, particularly the US.”

India imports around 85% of its total crude oil requirements and the International Energy Agency forecasts it will be the fastest-growing oil consumer in the world through 2040. It is expected that the nation’s oil consumption will increase from less than 5 million barrels a day at present to 8.2 million by 2035, as stated by Wood Mackenzie.

In the shorter term, growth in Indian consumption will lead a slowdown elsewhere. Last week the International Energy Agency reduced the global forecasts for oil demand growth this year and next. Not just that but they also warned that it might cut estimates further due to the US-China trade war. Indian demand-growth is expected to increase to 225,000 barrels a day in 2020, from 170,000 this year.

Russian exports to India have increased fivefold to 3 million tonnes in the year ending March 2018 after Rosneft PJSC and partners including Trafigura Group acquired a 400,000-barrel-a-day refinery near the Jamnagar plant.

The Aramco deal will help Reliance secure crude supplies. Reliance Executive Director PMS Prasad told reporters in Mumbai this week:

“In the current volatile geopolitical world, where we can’t buy from Iran, Venezuela is in trouble. Here is someone sitting three and a half days away, and they offer a bouquet of crude.”