Ever since smartphones & the internet have evolved, the banking process has become simpler and easier! Now, you can do any transaction or banking activity without moving from your home. You do not have to visit the bank branch to get your bank job done, as banking apps and SMS services are there to help you with your banking needs. Similarly, you can also generate your ATM PIN through SMS.

SBI is one of the popular and trustworthy banks in India. In this article, we will learn to generate SBI bank ATM PINs through SMS.

Stuck with an old ATM PIN and looking to reset the PIN or want to generate an ATM PIN for your new SBI Card? Follow the below steps.

Steps to generate SBI Bank ATM PIN through SMS

Generating SBI Bank ATM PIN through SMS is a pretty easy process. You don’t have to be tech-savvy for it. Basic knowledge of mobile phones will help you carry out this process.

- STEP 1: Make sure your mobile phone number is registered with SBI Bank. Now, go to the messaging app and type a message. Type PIN <last 4 digits of your ATM card> <last 4 digits of your SBI Bank account number>; Send this message to 567676.

- STEP 2: You will now receive an SMS that has the One Time Password (OTP). This OTP will be valid for 2 days. You can use this for 2 days.

- STEP 3: Using the received OTP, visit your nearest SBI ATM.

- STEP 4: Using the OTP, change or generate an ATM PIN from the SBI ATM.

- STEP 5: You can also follow the above steps to generate a PIN for your new SBI card.

If you didn’t know, the SBI Bank ATM PIN can also be directly set from ATM.

Steps to generate SBI ATM PIN from ATM

To set SBI Bank ATM PIN from ATM itself, you will need your debit card and mobile number registered with the bank. After having these, follow the below steps:

- STEP 1: Go to your nearest SBI Bank ATM.

- STEP 2: Insert your card into the ATM Machine and wait for the menu to appear on the screen.

- STEP 3: You will see several options. From those, select the PIN generating option.

- STEP 4: Now, Type your account number and your mobile number registered with the bank. Press Confirm button.

- STEP 5: You will receive an OTP in your registered mobile number for security purposes and confirmation.

- STEP 6: Note down this OTP and enter it when ATM asks for it.

- STEP 7: Now, you will be able to see the option to generate a new PIN or change the existing PIN for your SBI Bank debit card.

- STEP 8: The OTP you received is confidential. You must not share the OTP with anybody. This OTP will be valid for 2 days. You can change the PIN within that time.

Did you know? You can also change your SBI Bank ATM PIN or generate a new PIN through customer care. This option will also help you when you have forgotten your old PIN.

Steps to generate SBI ATM PIN through customer care

Follow the below steps to generate an SBI Bank ATM PIN through the help of customer care. This method can benefit those who have forgotten their existing SBI Bank ATM PIN or those who want to change their SBI Bank ATM PIN. Here are the steps:

- STEP 1: Using your mobile phone, call the number 1800 425 3800 or 1800 112 211. Note: These are toll-free numbers. You should call the customer care number from the mobile number you have registered with the SBI bank.

- STEP 2: Make sure you have your SBI Bank account number and SBI Bank ATM card in your hands for verification purposes.

- STEP 3: After your call gets connected, choose your preferred language. After selecting the language, click 2 for services related to the SBI Debit card or ATM.

- STEP 4: Now, click 1 for generating PIN.

- STEP 5: Click 1 again if you are dialling from the registered mobile phone number. If not, click 2. You will be redirected to the customer care representative.

- STEP 6: Now, follow the steps/instructions to finish the SBI Bank ATM PIN generation process.

- STEP 7: You will receive a temporary PIN to your registered mobile phone number.

- STEP 8: Now, you can visit the nearest SBI Bank ATM to change your SBI ATM PIN.

Note: This must be done within 24 hours after the receiving of the temporary PIN.

You can also generate the SBI Bank ATM PIN through internet banking. Below is the guide to do that.

Steps to generate SBI Bank ATM PIN through internet banking

You can generate SBI Bank ATM PIN via internet banking. This saves you a lot of time from physically visiting the bank to generate the PIN. You can generate the PIN from the comfort of your home. Below are the steps:

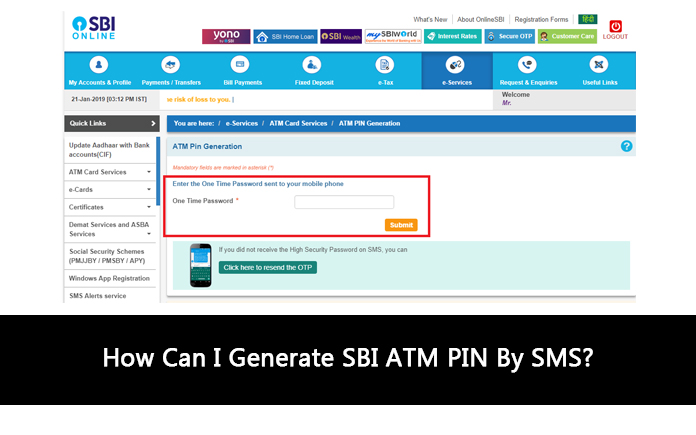

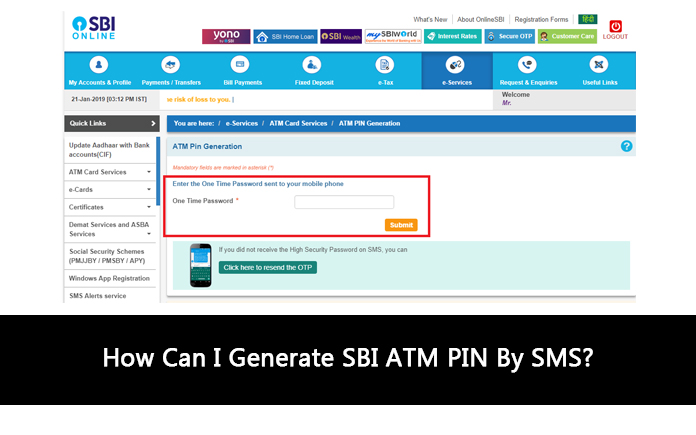

- STEP 1: Go to www.onlinesbi.com website.

- STEP 2: Now, log in to your internet banking account using your login ID and correct password.

- STEP 3: Check the e-services tab. Under this tab, you will see options. Select the ‘ATM Card Services’ option.

- STEP 4: Now, check for the ATM PIN generation option. Under this, you can see two ways. The first one uses OTP and the second one uses Profile password. Among the two, select your preferred method to generate the SBI Bank ATM PIN.

Note: If you select the OTP option, you will receive an SMS with a code to your registered mobile phone number.

- STEP 5: You should enter the number in the column asked. Now, you can select the savings account that is linked to your ATM.

- STEP 6: Press Continue. Select the ATM Card option and type the first 2 digits of your new ATM PIN.

The last two digits of the ATM PIN will be received by you on your registered mobile number through SMS.

- STEP 7: Type the two digits entered by you and the two digits you received through SMS on your mobile number.

- STEP 8: Press Submit button. Your SBI Bank ATM PIN is successfully generated now.

- STEP 9: You should know, the steps to change the ATM PIN via the profile password method is more or less similar.

Note: New SBI cardholders will be able to generate ATM PIN using the internet banking option only after activation of the Debit card through the ‘ATM card services’ tab, which you can find under the ‘e-services’ option.

We hope the above article helped you with all the information you needed to generate your SBI Bank ATM PIN. As there are several ways to do it, it is up to you to select your preferred method. Make sure you never share your login ID or password with anyone. Always keep it confidential. You should also avoid using shared networks while carrying out bank related activities. As your mobile phone has a bank app, it is also advisable for you to set a strong and unique password to keep your mobile phone safe. It will also protect your phone from strangers’ access. Share the article with your friends and family if you had found it useful!

Contents In This Article