In a very rare case scenario, the Reserve Bank of India works on the closure of major financial activities conducted by a private bank. Yes Bank fell under the purview recently. The bank though was begun with the help of the best professionals ran into very bad operations owing to a lot of reasons.

The unsteady financial position making the bank unable to provide loans, not having enough cash for withdrawing, lack of proper governance and fake assurances are some of the reasons why Yes Bank failed massively. Earlier, a lot of companies used to have their salary accounts with Yes Bank but many companies chose to close it when the crisis happened. However, for the individuals who have bank accounts with Yes Bank, it has become a very tough task for them to close their accounts with the bank as it is not possible online anymore. If you wish to close your Yes bank account, you have to visit the bank in person.

Reasons as to why a person wishes to close Yes Bank account

These are some of the reasons why a person wishes to close an account with Yes Bank.

- Less rates of interest

When a person deposits money in a bank, he always expects a higher rate of interest. A person’s account balance should be maintained so that the interest rate doesn’t get hindered. A customer before opening an account in a bank always compares the rate of interest between different banks and then only makes a decision.

Earlier when the bank was operating well, the rate of interest was pretty high. However, in recent times, the rate of interest provided dropped drastically.

- Lack of proper customer service

As the bank lost a lot of funds due to a lot of reasons, the customer service personnel were not ready to serve the customers in the best possible manner. The frontline customer service personnel were asked to move to another job when the bank management decided to cut down on the staff during the crisis.

- High value of minimum account balance

Generally, all the private banks have a higher amount of minimum account balance when compared to the government banks. In the case of Yes Bank, it was a bit higher and this was another reason why a person wanted to close his Yes Bank savings account.

- Bad relationship

Customer relationship management plays a pivotal role in retaining a customer.

The bank would have not had a great rapport with the customer and it would have led to him / her deciding to close this account with the bank.

- Multiple bank accounts

If the person is already having bank accounts in different banks, then he might decide to close this particular bank account with Yes Bank.

- Improper online service

As it is very evident that the bank is not performing great, the online services of the bank have been hit massively. It is practically not possible for a person to visit the bank every time they wish to have some banking-related activity.

- Account holder moves to another city

If the person who is having an account with Yes Bank in a particular City decides to move to another city, there are high chances that the person would want to close his bank account.

Steps to follow to close Yes Bank Account

These are the steps you need to follow if you want to close your Yes Bank account. Keep in mind that you can’t close the account online. You have to visit the bank in person. The steps are not way too elaborate and It is simple if you do it right.

Step 1: Visit the bank branch

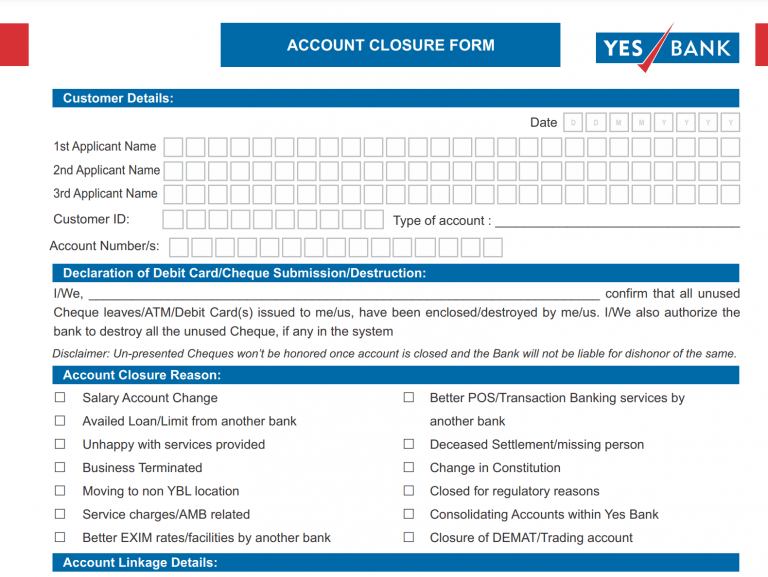

There are a lot of branches of the bank in the prime locations of the city. As you wish to close the bank account, you must hand over all the bank related documents to the bank at the bank counter and an account closure form is available. You have to fill in the form.

This form is available both at the bank counter as well as on the website of Yes Bank. If you do not want to waste time at the bank by spending minutes at the bank crowd, you could go for the downloading option from the website and then fill in all the required details in the form manually.

The account closure form is available online on the website of the bank in PDF format so that it is compatible with any kind of device.

-

Details to be filled in

The customer details section consists of the different applicant means the date, customer ID, type of account, account number.

If you are holding a joint account with the bank, then you are expected to write down the names of all the members. Small square boxes are provided for you to enter the details manually and it is expected of you to enter the details in capital letters.

The second section is the declaration of a debit card or cheque submission. The various documents of the bank like the cheque leaf and debit card or credit card should be handed over.

It is expected of you to have all the unused cheque leaf booklets when you are closing your account with Yes Bank. Also in the declaration, you authorize the bank personnel to destroy all of the cheque leaf and other bank-related documents. In the third section, you are asked to check either one or more boxes for the reason of account closure. This is a mandatory section and there is no OTHER option provided in the section.

Attach the KYC documents

The Know Your Customer documents should be attached to the account closure form. Various documents like PAN cards and Aadhar cards are generally attached along with the application form.

The documents should be attested as well. Once you submit all of these documents, the bank personnel would completely check all the documents and the form. It does take some time for your form to get processed by the personnel in the bank. This particular request will be handed over to the other departments where it undergoes a complete verification.

If you close your Yes bank account after 30 days of opening it, you would be charged INR 500 along with 18% GST. However, if you close the account within 30 days of opening it then, no charge is attached to it.

Letter to submit a bank

If you are not ready to fill in the application form to close your bank account, you can also submit your letter to the branch manager. In this section, the bank branch manager should be addressed with the branch name and the city. In the subject, you have to add, request to close the Yes bank account number. Once you have filled in your request, you have to sign the letter with the date and then submit it.

Withdraw the remaining account amount balance

You will have to withdraw the entire remaining amount in the bank account before closing the account as you cannot retrieve it after the account is closed.

What are some of the important points you need to keep in mind if you want to close the Yes Bank account?

It is not possible for you to reopen an account you had closed with the bank, so think twice. Also, have the account closure forms either in hard copy or soft copy format for future references.

Conclusion

These are some of the major points you need to keep in mind if you wish to close your YES Bank account. You can’t open a zero balance account with Yes Bank. The account closure though not available in online mode, is a much simpler process.

Contents In This Article