India is gradually adapting and growing its digital movement, especially in the banking sector. More and more people are now switching to mobile applications and internet banking to meet their banking needs. However, that doesn’t mean that physical banking isn’t there anymore. It’s quite the contrary.

Even the newer generation, who are more dependent on mobile applications, is now coming back to the roots and making use of cash and cheques. People are now switching to cashless transactions and using cheques is part of it.

However, since the use of cheques is not that prevalent, don’t be deterred if you aren’t sure how to read a cheque and issue one to make the banking transactions. When you receive a cheque as a payment choice that you have to submit to your bank to cash the cheque, there are several factors that you need to know of.

The information like the cheque number, bank and the branch is very crucial to know about. And, while this information is quite standard, the placement and availability can be a little tricky from one back to the other.

This article will explore how you can find the cheque number on the different SBI, HDFC, ICICI and Axis bank cheques in detail.

What comprises the Cheque Number?

Before we discuss the placement and availability of the cheque number on the different bank cheques, let us discuss a little more about the cheque number itself. What comprises the cheque number and how you can read it.

Here’s a quick breakdown of the same:

Header or Logo

The first part of your cheque that contributes to the identification is the header or logo of the bank. It should be printed on the top left corner of the cheque. Besides that, you will also find a range of other bank details printed on the cheque as well.

Payee and Payor (Payer) Details

The next part includes the details of the payee (the one who is receiving the amount) and the payer (from whose bank account the amount will be deducted).

Under this section, the customer had to mention the name of the payee, the amount that they will receive both in words and then there is a box where the amount has to be mentioned in numbers.

The last section is where the payer has to sign the cheque. This is very crucial if you want the cheque to be passed through. There shouldn’t be any kind of overwriting on the cheque because that will cancel the cheque pretty much immediately.

Numeric Numbers Printed:

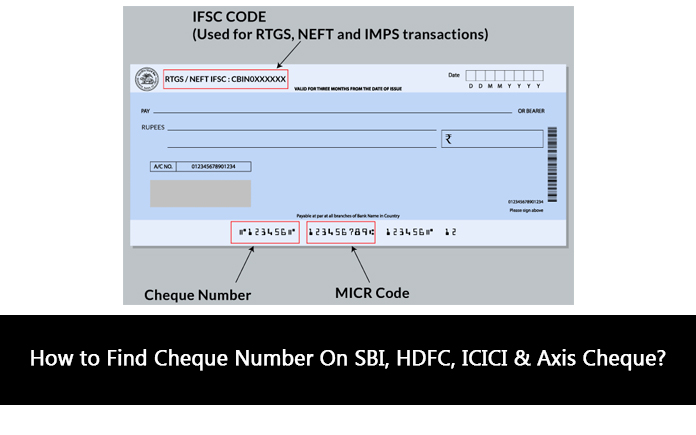

The last part of the cheque is the cheque number which we are posing so much importance on in this article.

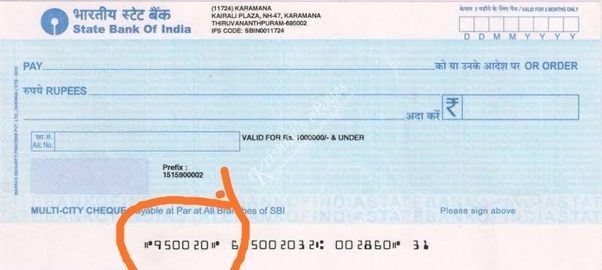

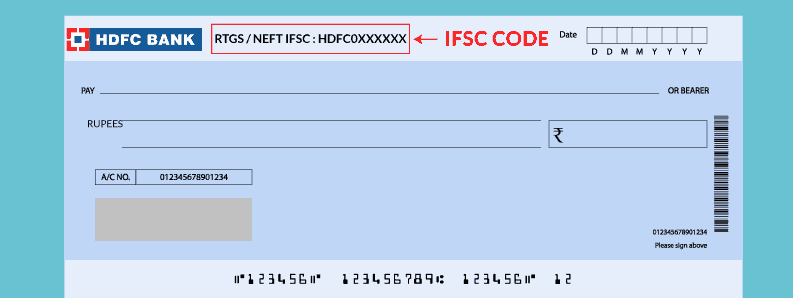

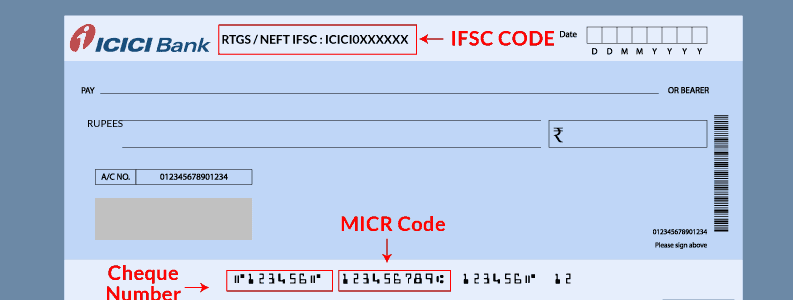

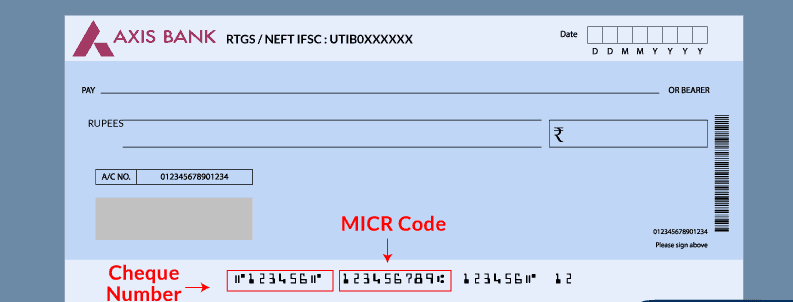

Amidst the numeric number, the first 6 digits signify the cheque number. This is a unique identification number that is different for every cheque.

Following are the highlighted cheque numbers of the popular banks like SBI, HDFC, ICICI and Axis bank.

SBI

HDFC Bank

ICICI Bank

Axis Bank

Besides the first 6 digits of the cheque number, the next 9 digits make the MICR code. Every three digits of the MICR code represent the city code, bank code, followed by the branch code as you can see above.

If you aren’t that familiar with cheques and their functionalities, we hope this article gives you all the basic inputs you need to know. Knowing the different elements or components of the cheque makes it a lot easier for you to use it in the future for your cashless transactions.

Contents In This Article

![11 Best Solar Water Heaters in India [2023]: Reviews Best Solar Water Heaters in India](https://cdacmohali.in/wp-content/uploads/2020/12/Best_Solar_Water_Heaters_in_India1-100x70.jpg)

![Domino’s Franchise in India [Cost, Profit & More] Domino's Franchise in India](https://cdacmohali.in/wp-content/uploads/2020/03/Dominos-Franchise-in-India.jpg)