Mobile banking can be called a boon to the banking sector. It not only made bank account access easy for customers but also gives users additional benefits like money optimization, better controls and clear clarity on what is happening with the account. Consumers can access their accounts 24/7 through mobile banking. This article will help you learn about registering for IDBI mobile banking or internet banking.

Two Ways to Register for IDBI Mobile Banking

Before knowing about mobile banking registration for IDBI bank, you should know the two ways to do it. IDBI Bank offers two steps to register for mobile banking. By learning these 2 steps, customers can have access to their bank account anytime, any day, and anywhere! Below are the two steps:

- Through SMS

- Through submission of Channel Registration Form at your nearby IDBI Bank Branch

Through SMS

Registration for IDBI Mobile Banking through SMS is a pretty simple process! We will tell you what to do.

- You should send an SMS to register your phone number.

- Type MBREG, leave Space and type your Customer ID.

- Send this message to the following number: 9560853000

Let’s say. If your customer ID is 45678945, then type that number. Now, send this text message to 9560853000. MBREG 45678945

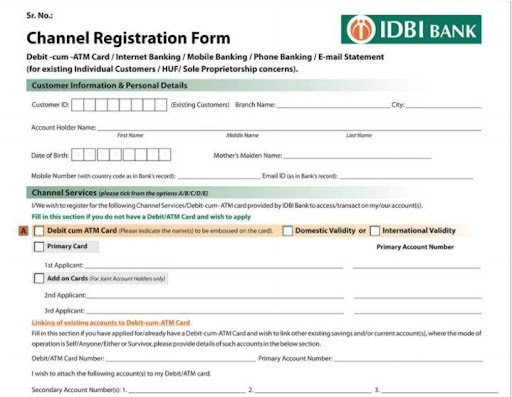

Through Channel Registration Form

- STEP 1: Go to IDBI Bank’s official website. Download the Channel Registration Form from there.

- STEP 2: Fill the form now. Fill in all the details/information asked in the form.

- STEP 3: Now, visit your nearest IDBI branch and submit the form.

- STEP 4: After the bank has reviewed your form, you will receive a message on your registered mobile phone number. You will receive a message saying mobile banking has been activated.

- STEP 5: Once your mobile banking is activated, you should set your password online. So, after receiving the mobile banking activation message, visit the official website of the bank www.idbi.com

- STEP 6: Now, Click the ‘Set Password Online’ option and create a new password for your mobile banking account.

- STEP 7: You are almost done. Now, you can go to the IDBI website and log in to your mobile banking account.

Follow the above steps to register for IDBI mobile banking. Now, check out the below guide to activate your IDBI mobile banking.

Guide for IDBI Bank Mobile Banking Activation

To activate the IDBI mobile banking, follow the below instructions:

You will need your debit card info and PIN for this purpose. Here are the steps:

- STEP 1: First, make sure you have the IDBI Bank app. If you don’t, download it from PlayStore.

- STEP 2: Now, activate the app by Clicking the‘ Activate app’ option.

- STEP 3: It’s time to verify your mobile number now. Type your Customer ID in the field.

- STEP 4: Now, press the ‘Activate’ option.

- STEP 5: Your app is ready for usage now.

Advantages of Mobile banking

Like we already mentioned, mobile banking comes with numerous advantages. The customers can access their bank account and details anytime they want.

- Mobile banking makes access easier and simpler

- Comfortable for usage; replaces physical bank visits

- Bank Account Access is available 24*7

- Customers have access to different transactions

- Plenty of info is available in various languages

- Fund transfers and transactions are easy and fast

- It is free of cost; you don’t have to pay for the benefits

- You can check your account balance whenever you want

- Request for chequebook and other requests can be made easily

Security Measures to be followed for IDBI Bank Mobile Banking

- Make sure your secure your mobile banking account with a unique password.

- Your mobile phone security is also important. So, ensure your phone is well protected and cannot be accessed by unknown people. For this, set a unique password for your mobile phone too. So, other than you, unknown persons cannot access your phone.

- Your mobile password should be strong and unique. Do not share the password with anyone for any reason. Keep it confidential. This is for your account security.

- The password can be a combination of both alphabets and numbers & also special characters.

- You can also change the password at least once a month for utmost safety and security.

- Do not write the password on paper or anywhere. Always remember it. So, set a password accordingly. If you had forgotten a password, you have an option to change it.

- If your phone has been lost, make sure you report the theft to the IDBI bank and a police station.

- Always add beneficiaries to your account only if they are trustworthy and close to you. Do not add beneficiaries whom you rarely know.

- You must not share your mobile banking login ID and Password with others. It must be kept confidential. Only you must know it.

- Follow and keep a track of the messages you have been receiving from the IDBI bank.

- Logging out of your mobile banking account is mandatory after you complete your transaction or fund transfers.

- Do not respond to hoax calls or messages. Never share your bank account details or phone number with anyone through the phone.

- Avoid using shared networks for making your bank transactions or fund transfers. Make sure the network you use is secured.

- Finally, do not proceed with the login and password typing in public places where other people may see it. Always be aware and cautious while using the mobile banking app.

Points to remember

- Your login ID and password are confidential and only you have access to it. So, apart from you, no one can access your IDBI bank account.

- Your IDBI bank account details are safe, well-protected and encrypted. This is done using the 128-bit Secure Socket Layer technology by the IDBI bank. So, you do not have to worry about data misusage or data theft.

- Make sure you type the login ID and password right. Because, if you mistype the login ID or password more than 5 times, your account will be automatically locked. You will not be able to use it until you contact the bank and get help.

- Your phone’s SIM card will not store or save any of your confidential bank info. The data within the app stays with the app. Your bank account details and information are well-protected.

- You can always contact IDBI Customer Care number – 1800 209 4324 – for any help or queries.

Apart from mobile banking, you can also carry out your banking activities through IDBI’s website. This is termed browser banking. For browser banking, you should just type the website address m.idbibank.com on your browser and start using the facilities offered.

You can do multiple bank activities including

- Checking cheque payments

- Checking account balance & other info

- Paying your bills (EB, Water, Insurance, etc)

- Recharging (DTH, Mobile phone)

- Fund transfer (Through IMPS and NEFT mode)

- Payments of VISA cards

- Cheque book requests

- Demat inquiries

- Accessing account dashboards, etc

We hope the above information was helpful to you! Keep watching this space for more useful updates.

Contents In This Article

![11 Best Solar Water Heaters in India [2023]: Reviews Best Solar Water Heaters in India](https://cdacmohali.in/wp-content/uploads/2020/12/Best_Solar_Water_Heaters_in_India1-100x70.jpg)

![Domino’s Franchise in India [Cost, Profit & More] Domino's Franchise in India](https://cdacmohali.in/wp-content/uploads/2020/03/Dominos-Franchise-in-India.jpg)