Punjab National Bank (PNB) is one of the most popular nationalized banks in India that is headquartered in New Delhi. The bank is owned by the Ministry of Finance and subsidized by the Indian government. The bank’s incidence dates back to the 1800s and has since then grown and evolved as one of the most mainstream banks in the country.

PNB is the third-largest and popular bank in India. With over 180 million customers and over 12,000 branches, the bank is consistently evolving and becoming the best as it grows.

However, we understand that there are several reasons why holding a bank account in the Punjab National Bank might not seem very practical for you. In that case, we’d highly recommend that you close the account via the online steps from the comfort of your home.

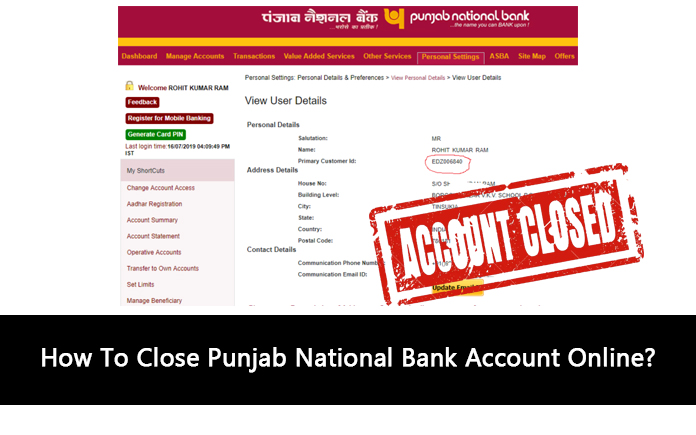

How To Close Punjab National Bank Account Online?

The process of closing a PNB bank account online is quite easy and can be done within a few minutes. These steps are applicable for both the savings and the current bank account.

Following are the steps that you need to follow:

- The first step is to collect and fill out the account closure form. You can get the same from the nearby PNB branch or you can end up downloading the same online too.

- Under the PNB account closure form, enter all the details, including the account number, customer ID and personal details as asked.

- You will also have to fill in the details of why you wish to close the account with valid reasoning.

- Once the details are filled in, the account holder has the option to choose how they want to handle their remaining account balance. It could be via cheque, cash or demand draft.

- Once you are done filling out all the details and have attached the required documents, along with the account passbook, debit card, cheque leaves, etc. to ensure rightful closure of the account.

- You will need to submit the KYC details for the bank account closure too.

Once all the documents and the bank account closure form are submitted, the bank will then process the application accordingly and then close the account. The account holder is notified accordingly.

If you want to streamline the process and not wait around in the bank to collect the form and then take ages to submit it, we’d recommend downloading it online via here.

Also, while closing your account, you need to be mindful of the minimum balance fee that you need to pay if the balance is less than that. So, make sure you are being mindful of that before you consider closing the account.

What is the minimum balance in PNB?

If you aren’t aware, like every other bank, even PNB comes with its limitations when it comes to handling the account that you are using as a savings or current bank account.

Keep in mind that the minimum balance prospect in PNB varies on the demographic of the branch your account is in. The charges will be different if you are in rural areas as opposed to if you are in metropolitan cities.

For the rural branches, the minimum balance is Rs. 500 while for the Metropolitan branches, the minimum balance is Rs. 2000.

What are PNB’s account closure charges?

Like any other government, nationalized or private bank in India, even Punjab national Bank comes with its subjective account closure charges that the users have to follow through.

Again, the charges will vary depending on the area that your bank account’s branch is in. So, if you are in rural sections, the charges will be less compared to if you are in urban areas.

- For recurring deposit account – Rs. 100 (within 1 year of opening)

- For PNB SF account – Rs. 200 to Rs. 500 (within 1 year of opening)

- For current account – Rs. 500 to Rs. 800 (within 1 year of opening)

These are very basic charges that are often levied in more or less every bank in India that you will come across. You must be mindful of the charges and process them accordingly.

How to Close PNB Account via Branch Manager?

If you want a quicker resolution and want to close the account for reasons that are very personal and immediate, PNB’s account holder can directly contact the branch manager for easier processing of the closure.

There are several standard formats for how you can write and leave an application addressed to the Branch Manager for the closure of the account. Always make sure that you are descriptive about the subject, attach all the involved documents along with the photocopy of the KYC details too since those are mandatory for the successful closure of the account.

How long does it take to close the PNB account?

The process of closure of the PNB bank account depends on a few factors. From the details that you have mentioned to the documents that you have attached; you need to be mindful of a lot of things when it comes to the account closure.

You must get a rough estimate from the bank. Sometimes, the account is successfully closed within a day, in other cases; it can take 3-4 days too. We’d highly recommend that you keep in touch with the bank to know about the progress.

Also, if you are going via the manager, the process should take less than a day to be done. Just ensure that you have all the documentation and the old account resources with you, ready to be submitted.

Conclusion

Closing a bank account, especially one under the government banks, is not as easy as it seems. You need to be mindful of a lot of factors that are involved in the account closure process. Ideally, it should take between a day to a maximum of 2-3 days for the account to be closed successfully. In case that doesn’t happen, make sure you contact the rightful people involved.

Contents In This Article

![11 Best Solar Water Heaters in India [2023]: Reviews Best Solar Water Heaters in India](https://cdacmohali.in/wp-content/uploads/2020/12/Best_Solar_Water_Heaters_in_India1-100x70.jpg)

![Domino’s Franchise in India [Cost, Profit & More] Domino's Franchise in India](https://cdacmohali.in/wp-content/uploads/2020/03/Dominos-Franchise-in-India.jpg)