HDFC is a leading name in the banking sector in India, offering the citizens reliable and on the go solutions. However, when it comes to transferring money over Rs. 2 lakhs to a different account, there are a few formalities that need to be sorted out. The HDFC RTGS Form is used for just that kind of transaction.

This is a form of NEFT form that is issued by HDFC when someone wants to transfer a sum of over 2 lakhs to another account. If you have been confused about this form or how to download the PDF format of the same, we hope this article gives you all the insights that you need.

What is the HDFC RTGS Form?

RTGS or Real-time Gross Settlement and & National Electronic Fund Transfer system (NEFT) are the two primary modes of bank transfers that allow easier, faster and secure transfer of funds from one bank account to the other. The same can be in between similar banks or it can be from one bank to another bank as well.

The money transfers were time-restricted before but NEFT is now available and accessible to the bank account holders throughout the day, which makes the process a lot seamless.

For RTGS transfers, there are a few restrictions, especially because the involved amount is quite large. So, the money can be transferred between Monday to Friday and 1st and 3rd Saturday between the banking hours of 10 am to 3.30 pm.

How to Fill HDFC RTGS Form or HDFC NEFT Form?

Now, if you are considering filling out the RTGS or NEFT form under HDFC to make fund transfers, there are easy ways in which you can do so. However, be assured that you need to follow through with quite a few important steps in the form that are important to fill out.

Here’s what you need to do:

- The RTGS form on HDFC has two different sections – one is for the beneficiary and the other part is for the remitter.

- During filling out the application process, the customer has to fill out a range of information, including the sender’s details, name, address, contact details, account details, IFSC code, and the amount they want to transfer.

- Once all the details are submitted, you can process the transfer. Keep in mind that the RTGS form is only for transactions above INR 2,00,000.

If you want to make a money transfer for a smaller money transfer before INR 2 lakhs, then you need to fill out and use the NEFT form for the same.

What documents would you need for the RTGS Transfer?

As we had said, the RTGS transfer involves a large sum of money. To ensure that the transferred amount is safe and secure during the transaction, it isn’t surprising that the bank needs access to a few important details, including:

- HDFC RTGS/NEFT Application Form PDF

- Cheque leaf

- Pan Card

- Other ID proof like Aadhar Card

HDFC RTGS/NEFT Form – Online Apply Procedure

Once you have all the documentation sorted, here’s a quick rundown of the application procedure online. Be assured that the money transfer can be done offline at the bank’s branch directly. However, if you are stuck at home or want to get everything done from the comfort of your home, you can download the form online and then proceed with the fund transfer accordingly.

Here’s how to apply for the same online:

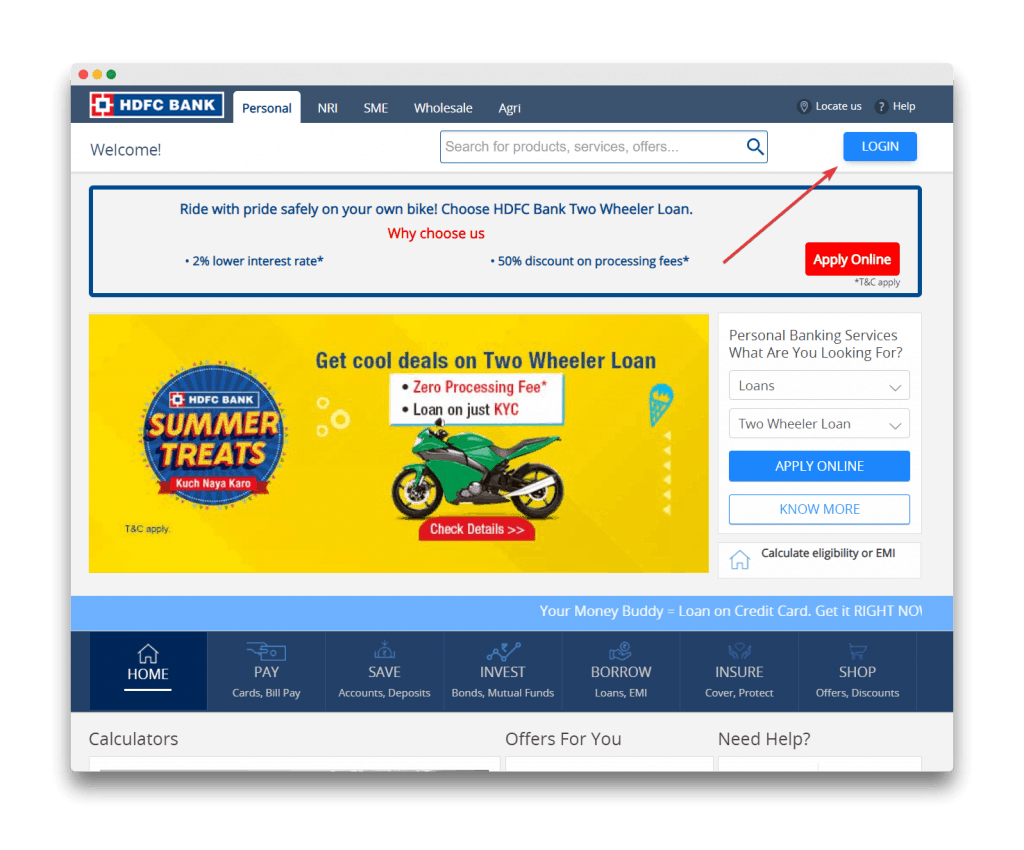

- Start by opening your browser and then open the official website of HDFC at https://v1.hdfcbank.com/

- Once you are on the homepage, log in to use the internet banking facilities. You’d need your customer ID and password for the same.

- Under Netbanking, click on login and successful log into the portal.

- Once you are logged in, you then need to enter the beneficiary details, if you haven’t done the same before.

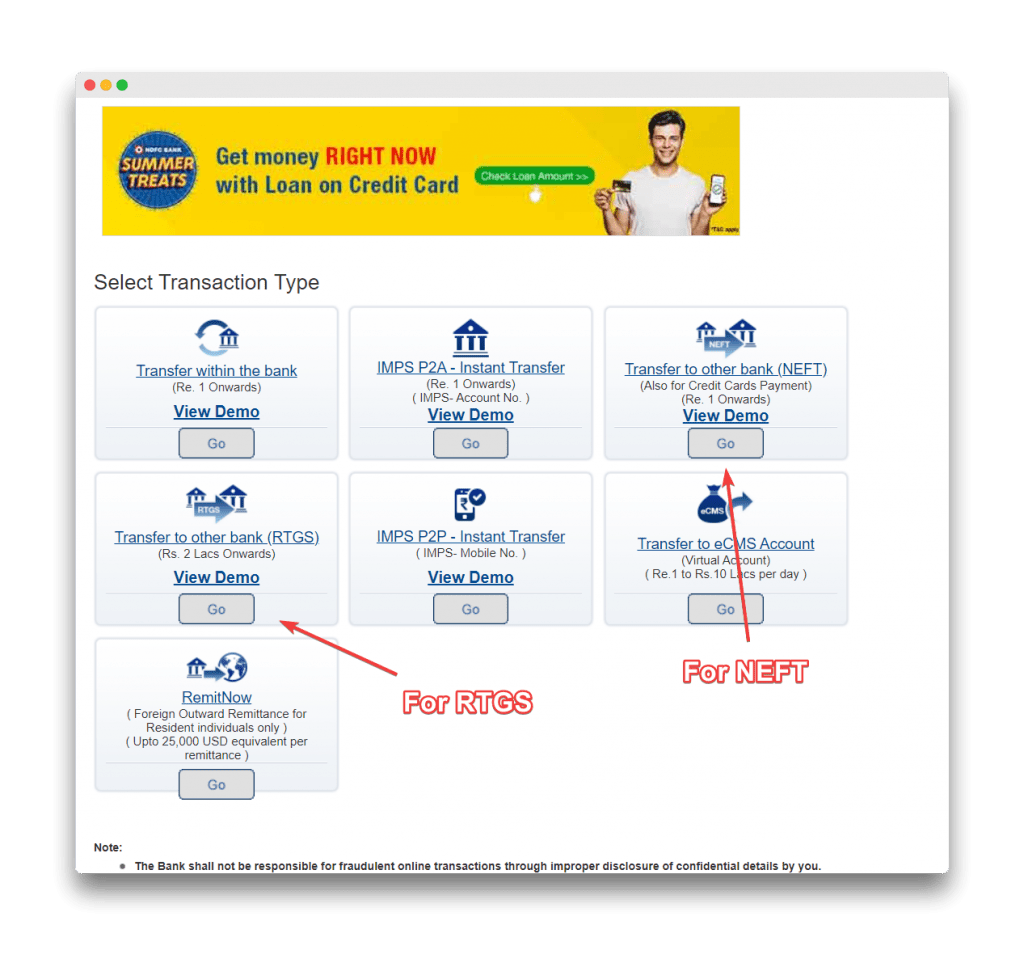

- Once done, navigate to the RTGS option.

- Click on the RTGS tab and fill out the application form with all the details as asked on the page. You have a separate tab for making NEFT transactions.

- Once you have filled out the information and entered the amount that you wish to transfer, you can proceed to confirm the same to make a successful fund transfer.

Once the application is submitted and verified, the funds will be transferred immediately. The recipient will likely have the amount credited to their account within 1-2, max 3 hours.

Is transferring money via the HDFC RTGS form safe?

When it comes to money transfers, any amount is precious. It doesn’t matter if you are transferring 1 rupee or you are transferring 1 lakh rupees, you are most definitely going to be stressed whether the recipient received the money or not. This is a very common feeling that is prevalent among more or less everyone around you.

However, the RTGS and NEFT money transfer processes are done and developed to help with such issues. Ideally, we’d recommend that you always transfer the amount via reliable channels, like from the bank or via other payment transfer platforms like HDFC’s mobile application.

When you are transferring larger amounts, it is always safe you use the payment channels that are approved by the bank. This ensures that in case something does go wrong, you can get immediate assistance with the money and you won’t have to repent through.

However, we understand that transferring money online is not an easy process. You have to be very careful with the fund transfer, check and recheck every digit that you have entered before you press on confirm and end up transferring the amount to a third-party platform.

Conclusion

If you don’t rely on online transfers, you can always download the application in PDF format, fill in the details and then make the transfer from the bank itself. This is considered a lot safer option for some bank account holders. However, this is a more tedious process that requires you to visit the bank and make the transfer manually.

Contents In This Article

![11 Best Solar Water Heaters in India [2023]: Reviews Best Solar Water Heaters in India](https://cdacmohali.in/wp-content/uploads/2020/12/Best_Solar_Water_Heaters_in_India1-100x70.jpg)

![Domino’s Franchise in India [Cost, Profit & More] Domino's Franchise in India](https://cdacmohali.in/wp-content/uploads/2020/03/Dominos-Franchise-in-India.jpg)