Internet banking has helped in providing a lot of financial services to consumers. It is not required of the consumer to visit. the bank branch where they had opened their account if they wish to conduct banking-related actions.

Axis bank has never failed to constantly renovate how they offer their services to their customers. The internet banking facility provided by Axis Bank helps one to use the online portal to make transactions and conduct other activities.

If the Axis Bank customer wants to use these services rendered by Axis Bank in the internet banking portal, all they have to do is to activate their bank account. The activation process is not very complex and it hardly takes two minutes for the entire procedure to be completed. There are a host of activities you could perform online using Axis Bank Internet Banking like fund transfer, asking for a new chequebook, checking the account balance etc. Internet banking provides users with the freedom to conduct banking activities from the comfort levels of their homes.

Steps to follow to Activate Axis Bank Internet banking

The steps involved in the activation of Axis Bank Internet Banking are not very complex. If you follow the below steps dutifully, then the entire process is very simple.

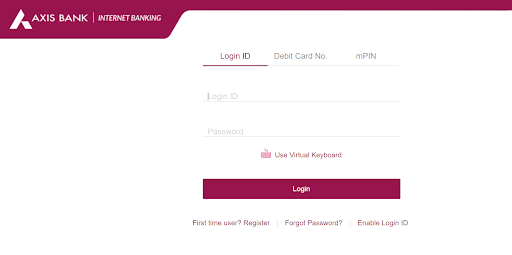

Step 1: Visit the homepage of the internet banking portal

The Axis Bank Internet Banking portal has to be visited. Once you visit the right website, you could see a button flickering Register on the extreme left side of the screen.

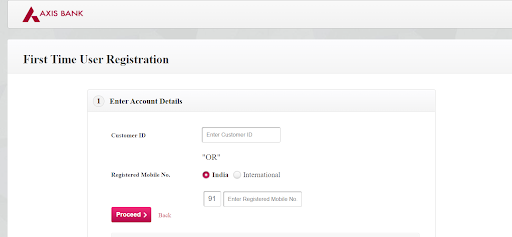

Step 2: Enter the credentials

You are supposed to enter the credentials, like the mobile number registered with the bank or the customer ID.

From this, it is evident that you could make use of the internet banking service only after registering yourself with the bank and opening a bank account with the Axis Bank

A customer ID is only generated after you open a bank account or register yourself to avail of the services offered by the bank.

One must keep in mind that a customer ID is different from the account number.

You could open a bank account both online and offline medium. If you open your bank account in offline medium, you will be provided with a list of documents and in the chequebook itself, you would be able to find the customer and also in the passbook given to you by the bank. You can open a bank account online by having an Aadhar card or any other relevant proof of residence document and other mandatory documents like a PAN card.

So once you’ve registered with your bank, then you have to enter the valid credentials. Upon entering the mobile number or customer ID, the screen will prompt you to enter the bank account number.

You are supposed to enter the other details requested on the screen before clicking on the proceed button.

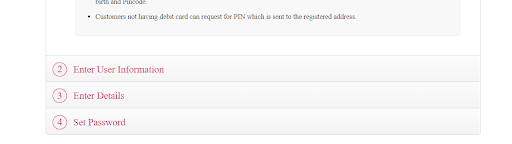

When you open a bank account, you will be provided with a PIN. This must be entered if you wish to set it for your internet banking.

The mobile number and 4 digit PIN will be registered and integrated with your bank account number.

What to do if you have forgotten your customer ID?

If you had lost the passbook or the document where you can find the customer ID, there is a very simple way to find out. You would have registered your mobile number with the bank. You have to send an SMS in the format CUSTID to the number 567682. Upon sending this SMS, you could see the bank customer ID.

Once you click on the proceed button, you will be asked to enter the debit card details. The debit card contains a 16 digit number pattern on it and it also has details like expiry date and CVV number. You have to enter all of the relevant debit card details and choose currency as an Indian rupee before accepting the terms and conditions checkbox.

After completing all of this, you have to click on the proceed button. You need to have your registered mobile number handy because you will be provided with the OTP. Make sure to have a proper SMS balance in your mobile phone as you would not receive SMS if you had not registered the mobile as well recharged it.

Step 3: Create a password

The third step is to create a password. Only after entering the right PIN, registered mobile number and other essential details like mobile number, you will be asked to create a password for your internet banking.

Ensure that the password contains uppercase, lowercase, number and special symbols to make your password strong and protect it from hackers. You will be asked to re-enter the password to confirm if both are the same.

Upon clicking the proceed button, you will be getting an OTP on the registered mobile number. You have to enter the OTP to confirm that you have entered the password. These are the steps you need to follow to register yourself for Axis Bank Internet Banking.

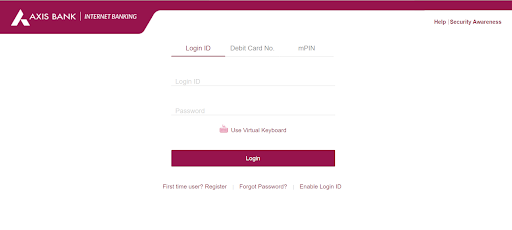

Login procedure of Axis Bank Internet Banking

You could log in to Axis Bank Internet Banking only after registering for the internet banking services. The very same banking portal site has to be visited. You could click on the button that shows login. You would have created a password at the time of registration. The login ID and the password should be entered to log onto the portal. The login ID is generally the customer ID or your mobile number.

Once you click on the login button, you will be able to access the services provided to you by internet banking.

What are the benefits of using Axis Bank Internet banking?

There are a lot of benefits of using Axis Bank Internet banking. Some of the top ones are listed below.

- Account Details

You could check all your account details in one place right from account statement to balance. It is also possible to download your account statement in PDF format and have it for reference.

- Fund transfer

24×7 fund transfer is possible only in online Internet Banking. If you use the brick and mortar bank branches for transferring money, you could do it only during the bank working hours whereas, in the case of internet banking, you could transfer funds any time using the receiver details like ifsc code, account number, name of the bank.

- Payment and Bills

Almost all of the essential service providers have registered themselves with different banks so that payment of different bills and services offered by them is made easy by making use of Internet Banking.

- Investment opportunities

If you are new to investing in stocks, you need not worry as this internet banking would open the doors for you.

The Initial Public offerings of the various stocks listed in exchanges are listed in various banks so that it is easier for people to invest in the right stocks to earn money.

Conclusion

This provides you with a clear-cut idea of how you are supposed to register yourself for Axis Bank Internet Banking and once you start using the internet banking facilities, you would be interested in knowing about the other services you could avail not just transfer of money. The excellent support team of Axis Bank would also assist you if you face any kind of issues with registering yourself for Internet banking online.

Contents In This Article

![11 Best Solar Water Heaters in India [2023]: Reviews Best Solar Water Heaters in India](https://cdacmohali.in/wp-content/uploads/2020/12/Best_Solar_Water_Heaters_in_India1-100x70.jpg)

![Domino’s Franchise in India [Cost, Profit & More] Domino's Franchise in India](https://cdacmohali.in/wp-content/uploads/2020/03/Dominos-Franchise-in-India.jpg)